Insights & Reviews

Top Credit Cards for Car Rentals in Germany

We'll review the best credit cards in Germany for car rentals, focusing on those with built-in rental insurance to save money and reduce hassle. It compares top options like Barclays Platinum Double, Santander Bestcard Premium, and Amex Platinum, highlighting their key benefits and drawbacks. A credit card comparison tool is recommended to help travelers find the best fit.

by Dmitry Filippov

Updated 2 January 2025 - 4 minutes read

Top Current Accounts in Germany for Salary Earners

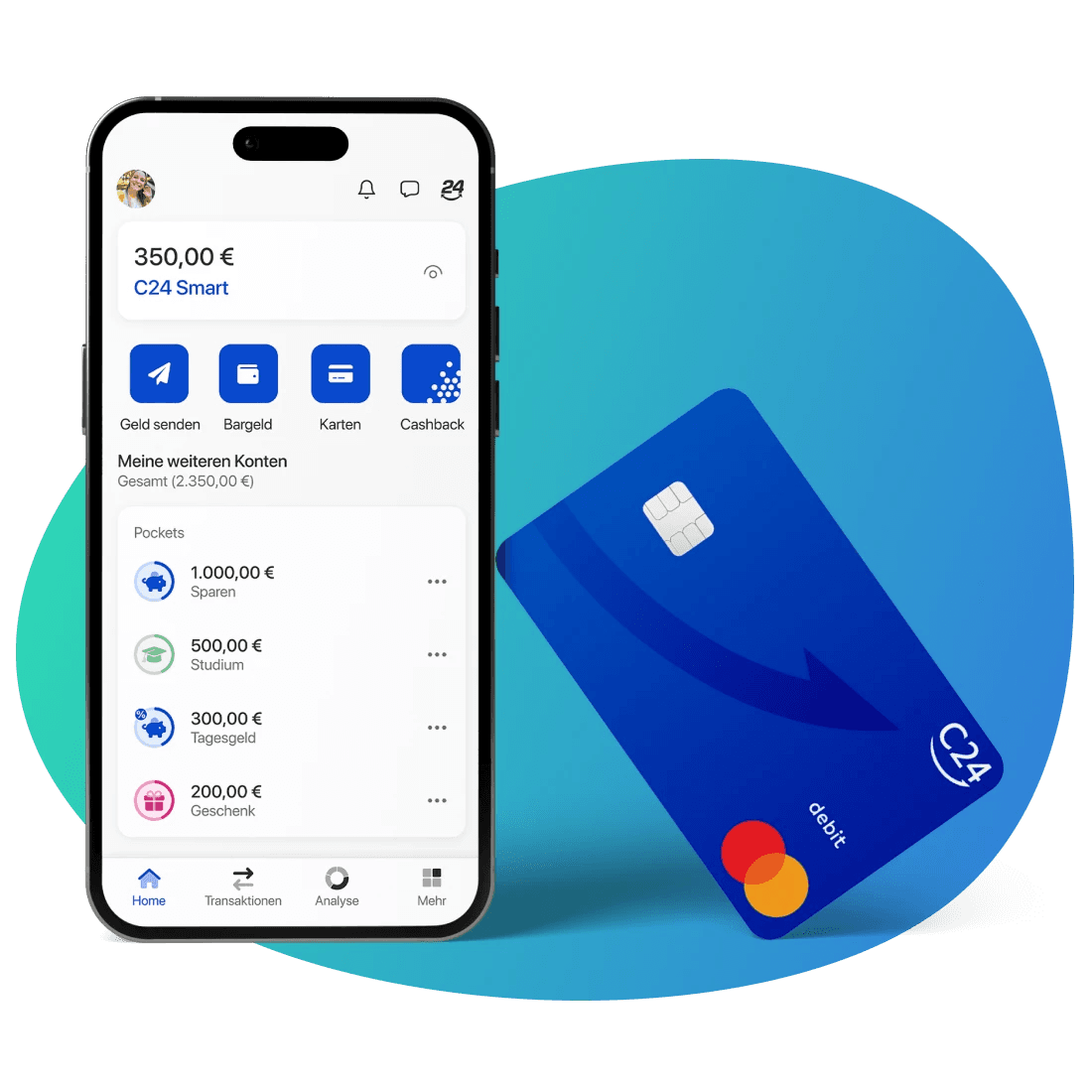

This article reviews the best current accounts in Germany for salary earners, highlighting key features, fees, and benefits of five popular options: C24 Smart, Santander 1|2|3, N26 Standard, DKB Girokonto, and ING Girokonto. It covers aspects like free account management, interest rates, overdraft conditions, card offerings, and cash withdrawal options. The guide helps readers compare accounts based on their income and banking needs, emphasizing digital services, loyalty bonuses, and fee structures.

by Dmitry Filippov

Updated 2 January 2025 - 4 minutes read

Amazon Visa: A Complete Review of the Free Cashback Card in Germany

The Amazon Visa credit card is back with new features after a year off the market. It offers 1% cashback on Amazon.de purchases, 0.5% on other purchases, and up to 2% cashback for Prime members on select days. The card has no annual fees and can be used in two modes: charge (no interest if paid in full monthly) and revolving (high interest at 20.13% p.a.). The optional Travel+ package (€7.99/month) waives foreign currency fees and ATM withdrawal fees, making it useful for occasional travelers. While the card has some app issues and high cash withdrawal fees, it’s a solid choice for regular Amazon shoppers.

by Dmitry Filippov

Updated 2 January 2025 - 10 minutes read

C24 Smart: Current Account That Pays You

The C24 Smart account offers a free, feature-rich banking experience with 1.75% interest on balances, free instant transfers, Girocard, Mastercard, virtual cards, and 0.05% cashback. It also includes free worldwide ATM withdrawals and no currency conversion fees. The account lacks long-term savings, trading options, and credit products. Overdraft is available after three salary deposits, and services are in German. Despite these, the reviewer highly recommends C24 Smart for its modern features and rewards.

by Dmitry Filippov

Updated 2 January 2025 - 10 minutes read